Theories of Change in Impact Investing

- @Alcanne

- May 27, 2019

- 2 min read

ACTION & REACTION of Investors, Finance & Investees.

In Impact Investing the limited availability of (inclusive) impact investment products steer investors towards different(iated) impact levels, preferred investment products & impact assets allocation.

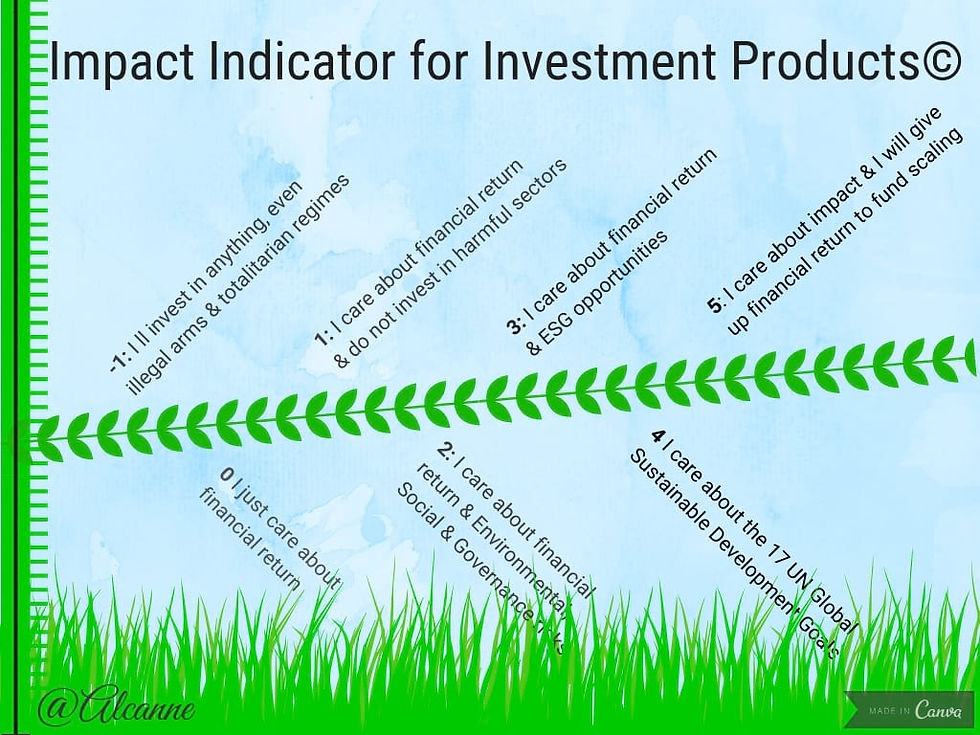

E.g. in fixed income green or muni bonds, health property, farmland REITs or SDG investment funds etc. Of course all investments have impact, but impact investing aims at doing well & doing good, which in today's investment market practice varies mainly from doing less harm (the largest offer in investment products) to having positive, broad and/or deep impact. It is an impact ladder developing with growing transparency & product innovation.

Defining a Theory of Change is a strategy for impact investors to define how to achieve impact, their societal & environmental goals. Just as their financial strategy or mandate defines the risk appropriate return goals. For those overwhelmed by the choices, discourse & reasoning in the impact investment universe, I will briefly sketch impact investment choices i.e. actual market offerings & trends such as Exclusion, Engagement, ESG Integration and more impact ambitious goals such as SDG contribution as Theories of Change. It is not intended as a philosophical thought piece & soul searching clarification of the theories, on the contrary it aims to be a simplification regardless of ethical, ideological or sustainability motivations. THEORIES OF CHANGE are like INVESTMENT MANDATES:

guiding principles to achieve goals.

'Balancing impact & return' mandates can be exclusion guidelines and/or allocation to low(er) ESG (Environment, Social & Governance) Risk Exposure and / or Selection of ESG Opportunity, Best-in-Class investments, SDG & (Deep) Impact Investments.

IRD Innovation, Research & Development activities often overlap with ESG activities & the ESG universes IRD gives (sub)sectors crucial data on Material Sustainability investments (SASB Materiality matrix 79 sub sectors) eg on environment (e.g. energy use), human & social capital, the business model & governance

In the slideshare presentation I will describe investors goals, finance sector activities & investee options such as:

Selling, splitting sin sections for future sales or seperate fundraising;

Adopt & Implement easy sexy solutions from relevant ESG indices/themes;

Take Stock of Material ESG issues & topics;

Develop tailor made ESG policy;

Utilize it as an USP, competitive advantage for Investor & Public Relation.

Comments